The Case for Dividends:

Seize the Moment as $6.3 Trillion Moves out of

Money Markets and into

Wealth-Building Dividend Stocks

AT A GLANCE:

Dividend stocks have consistently outperformed in both bull and bear markets, acting as a defensive shield against volatility and as a powerful tool for income-driven growth.

There is $6.3 trillion sitting in money market funds. With interest rates falling, that cash will soon seek the higher returns that dividend stocks can deliver.

Investors have the chance right now to lock in attractive entry prices on solid dividend stocks—which equates to higher yields—before the window closes.

Table of Contents

Part 1. The Enduring Appeal of Dividend Stocks

The Origins of Dividends and Outperformance over Time

The 1900s: A Century of Growth

Dividend Growers Are Even Better

Lower Volatility, More Stability

Part 2. The $6.3 Trillion Opportunity

The Shift to a Rate-Cutting Cycle: How Falling Interest Rates Create New Income Opportunities

The Fed’s Next Moves

Investors Flock to Safe Havens Whether Rates Go Up or Down

Part 3. Now Is the Time to Buy Dividend Payers

The Inevitable Search for Yield

Let Dividends Work for You

A Simple, Low-Maintenance Way to Build Wealth

Don’t Forget Dividend Royalty

Part 4. What to Do Next: Amplify Your Income in a Shifting Market

Closing Remarks

What to Do Next

Find Your Next Dividend Stock

Part 1: The Enduring Appeal of Dividend Stocks

How Dividends Were Born and Why They Outperform over Time

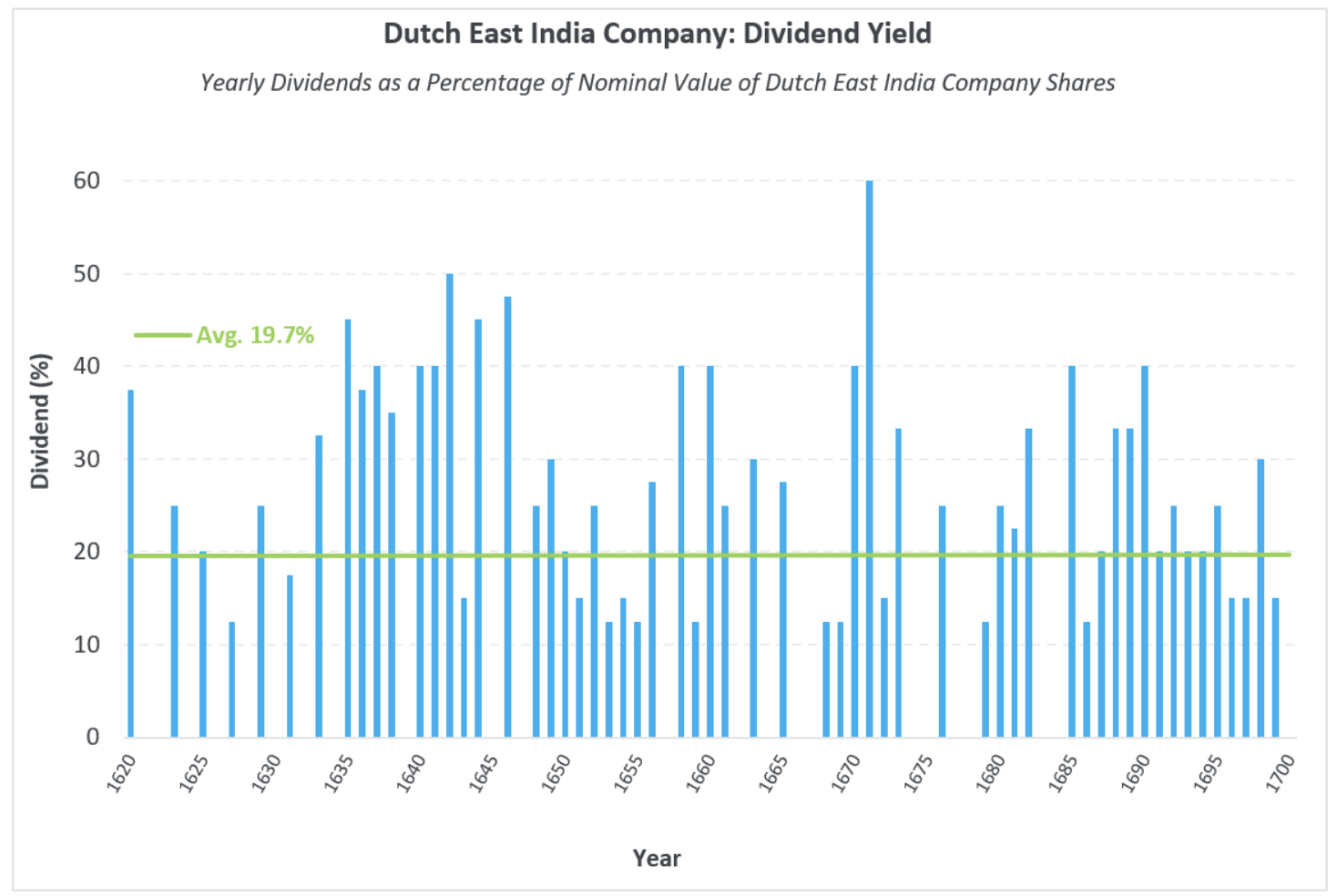

The concept of dividends traces back to the early days of exploration and trade, long before modern stock markets existed.

In the 15th and 16th centuries, expeditions offered investors the chance to profit from single voyages.

Investors would finance a ship and, if successful, receive a share of the profits—but if the voyage failed, they lost everything.[1]

That all changed in 1602 when the Dutch East India Company—the “Amazon” of its time—transformed global trade.

Under pressure from investors, it finally issued its first dividend in 1610—not in cash, but in mace, a prized spice.

By 1612, the company began issuing cash dividends, marking a turning point in financial history.

Source: Canvas

This story is more than a historical footnote; it’s a key moment that forever changed the course of financial history. It set the stage for how dividends shaped the relationship between companies and investors, driving wealth creation and portfolio strategies.[2]

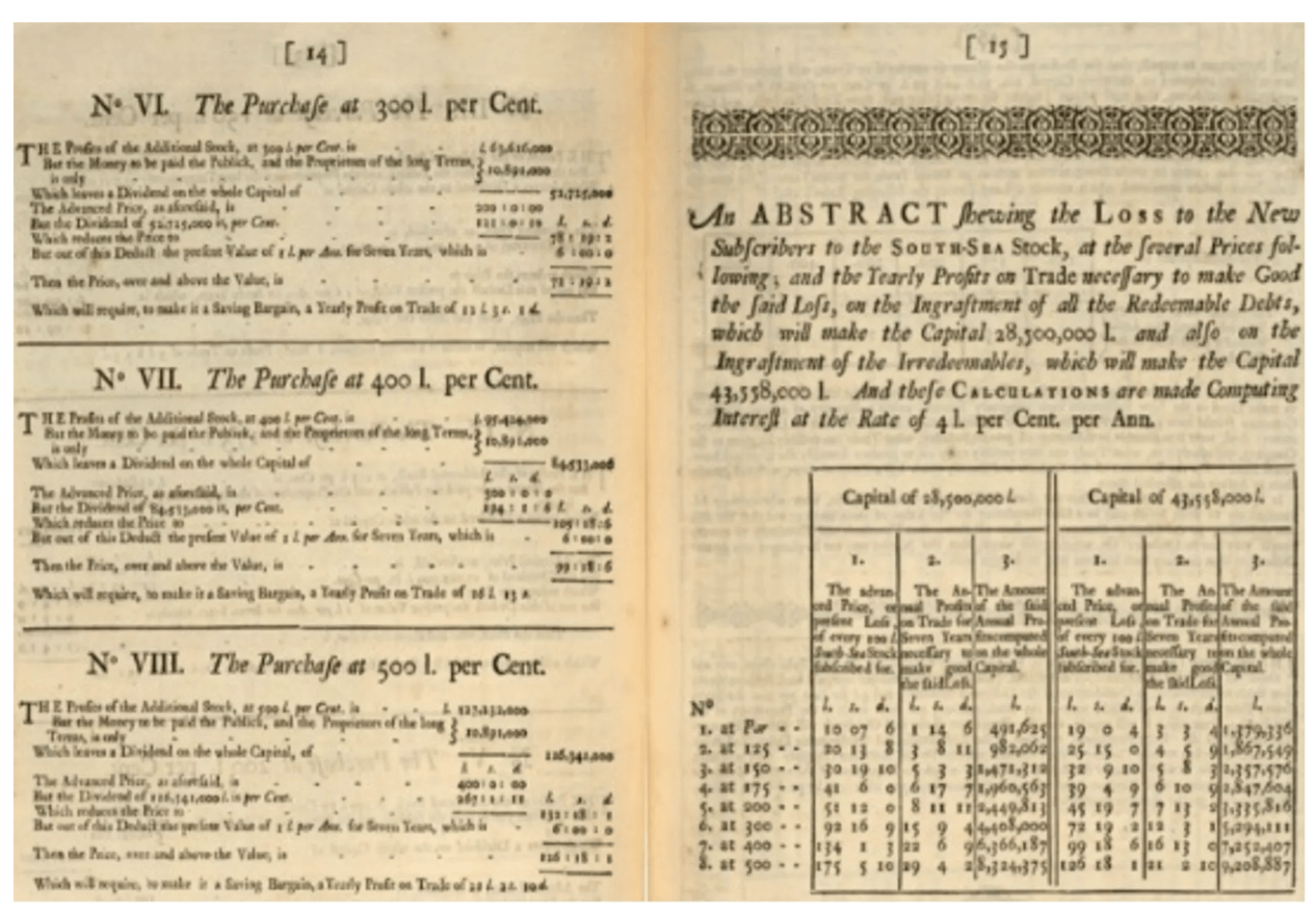

Fast forward to the bubbles of 1720—the South Sea and Mississippi Company manias—when investors began to truly grasp the importance of regular payouts.

While many investors were caught in speculative frenzies, the savvy ones turned to dividends as beacons of stability and reliable measures of value.

This snapshot from a 1720 pamphlet explained how dividends justified buying shares of South Sea during a speculative mania, establishing a framework for value in volatile times:

Source: blog.countercyclical.io

“The main principle on which the whole science of stock jobbing is built, viz. that the benefit of a dividend is always to be estimated according to the rate it bears to the price of the stock, because the purchaser is supposed to compare that rate with the profits he might make of money, if otherwise employed.” [3]

After these bubbles collapsed, dividends endured as a cornerstone of reliable, long-term investing—delivering steady income and a practical measure of a stock’s true value even in the chaos of speculative manias.

By the 19th and early 20th centuries, dividends were the primary measure of a company’s financial health, especially when access to detailed financial data was limited.

In both the UK and the US, investors relied almost entirely on dividend payments to assess a stock’s value—there were no quarterly reports or balance sheets, just limited scraps of information

Analysts developed valuation tools like dividend cover, which measured how many times profits could pay the dividend.

In 1915, for example, James Book & Co. issued shares with dividends covered five times by profits—a clear sign of stability.[4]

Investors also compared dividend yields to earnings yields to evaluate the sustainability of payouts in an era of scarce financial transparency.

The 1900s: A Century of Growth

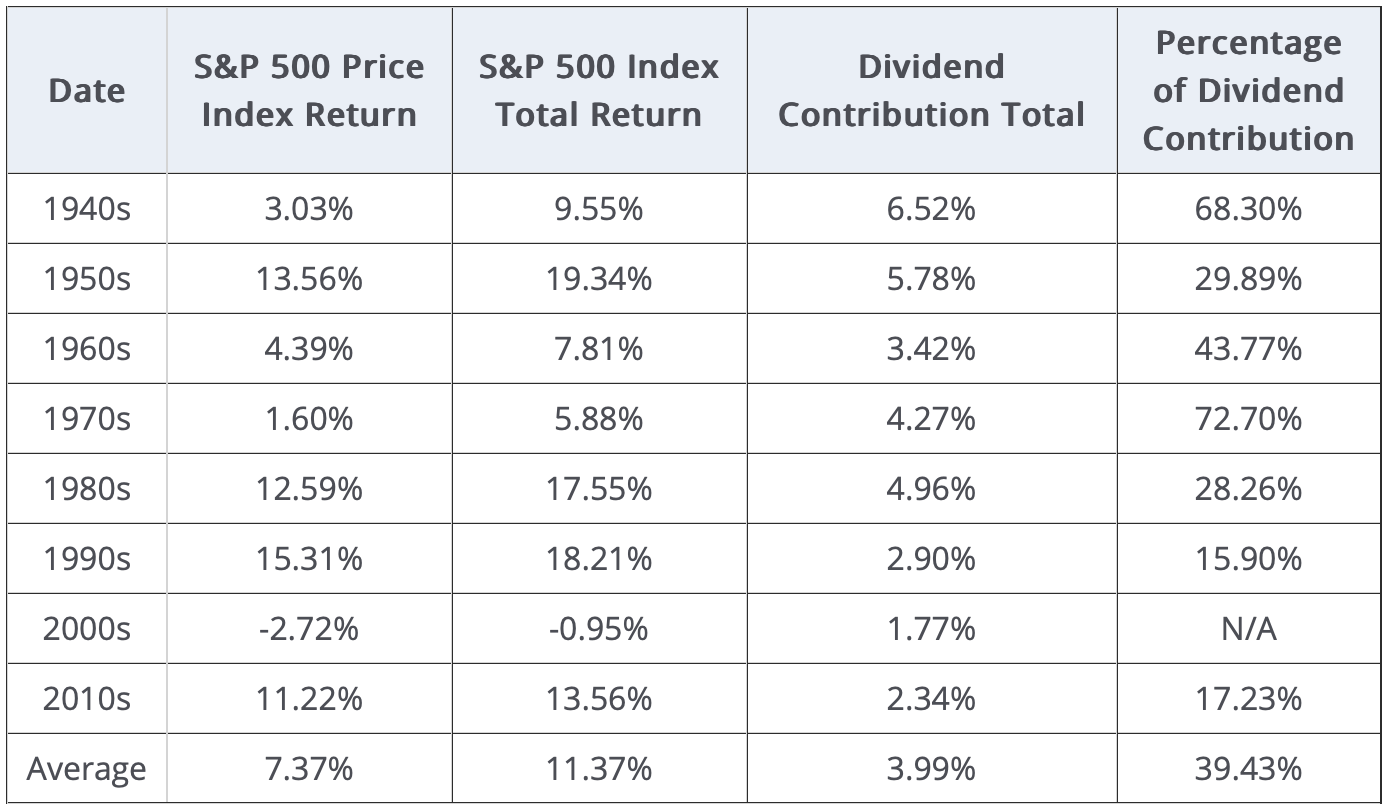

Since the 1940s, dividends have contributed an average of 39% to total returns in the S&P 500, though their impact has varied across different market environments.

During the inflation turmoil of the 1970s, dividends provided resilience, accounting for 72% of total returns. Even in high-growth decades, like the 1980s and 1990s, dividends made a double-digit contribution to market returns, proving their lasting role in overall performance.

Source: Hartford Funds

In the tech-driven 2000s, dividends took a back seat. Still, companies that continued to pay them, especially after the 2008 financial crisis, proved their strength and stability.

The takeaway?

Dividends aren't relics from an antiquated era—they’ve remained a cornerstone of wealth building for centuries, valuable in every economic era—from the Dutch East India Company to today's leading companies.

Businesses that consistently pay and grow dividends have demonstrated resilience and long-term outperformance across all market conditions.

With steady dividends, investors can secure a reliable income stream and build long-term wealth—even in uncertain times.

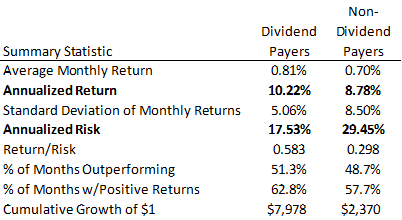

From 1927 to 2017, dividend-paying stocks outperformed non-dividend payers more than threefold.

Dividend payers return capital to investors, while non-payers rely solely on share price appreciation.[5] [6]

Source: Seeking Alpha

The immense long-term wealth-building power of dividends is undeniable.

Dividend Growers:

The Story Gets Even Better

Some companies simply pay a steady dividend, while others consistently raise their payouts year after year.

The long-term outperformance of these dividend growers is even greater. Investors use this attribute to steadily boost their passive income streams. Or, if dividends are reinvested, dividend growers will leverage the compounding effect and super-charge wealth building.

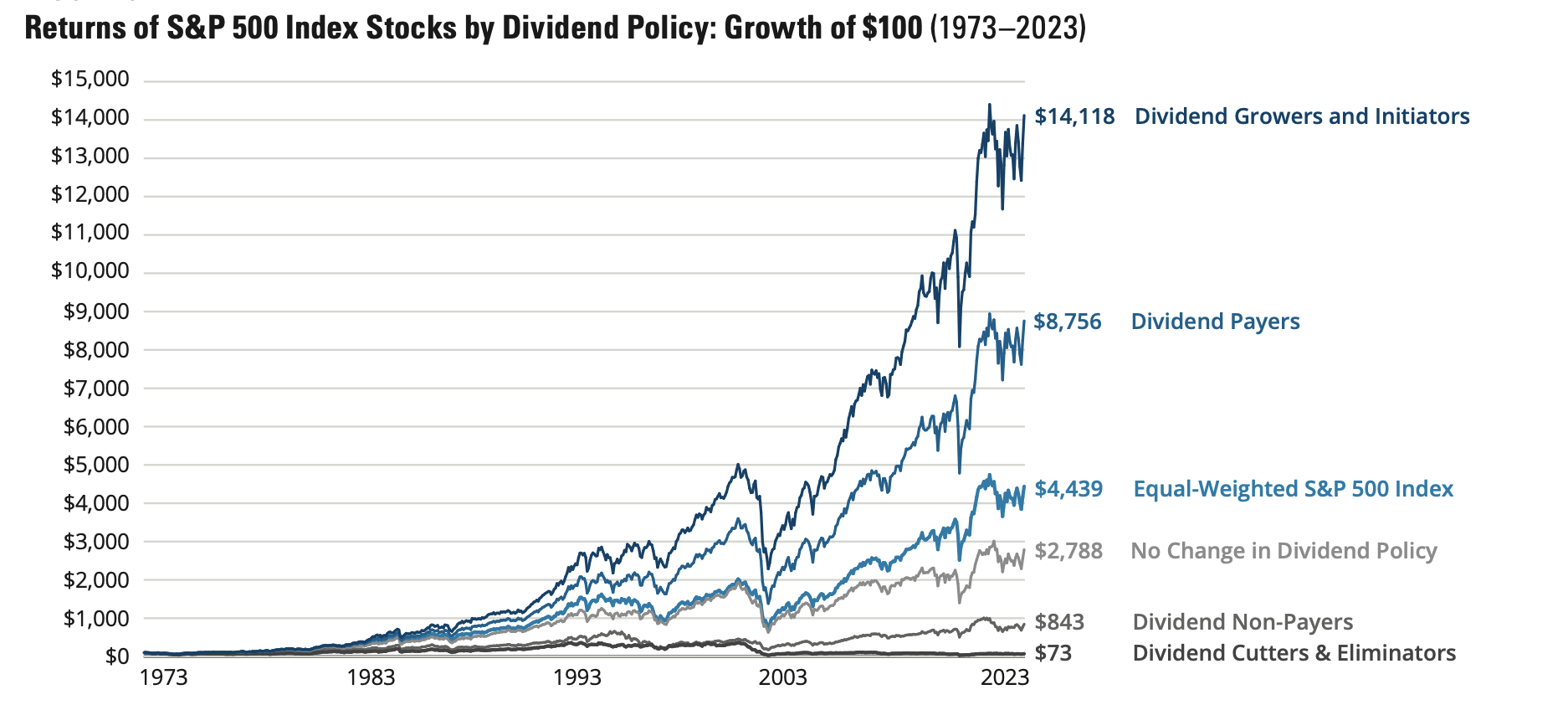

For instance, from 1973 to 2023, dividend growers turned a $100 investment into $14,118. That return totally crushed the $4,439 from the equal-weighted S&P 500 and the meager $843 from non-dividend payers.[7]

Source: Stokes Capital Advisors

Dividend growth is more than just a sign of a company’s financial strength. It is a key driver of total returns over time.

The ability to grow payouts—even during challenging periods like rising interest rates or economic uncertainty—makes dividend growers a smart choice for long-term wealth building.

Less Volatility, More Stability

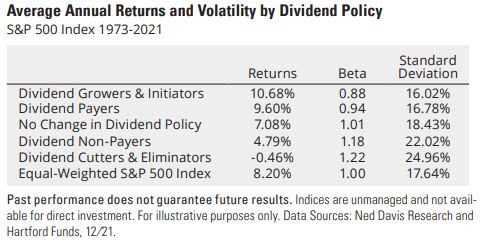

Dividend payers not only provide higher returns, they also offer greater stability during volatile periods.

This is great for investors seeking a balance between higher income and wealth protection.

From 1973 to 2021, dividend growers and initiators had an annualized return of 10.68%. That significantly outperformed non-dividend payers at just 4.79% and did so with less volatility.

This combination of higher returns and lower risk is especially relevant in today’s unpredictable economic climate, which is marked by fluctuating interest rates and geopolitical uncertainty.

The data confirms that dividend payers have an annualized risk of just 17.53% versus 29.45% for non-dividend payers. This means these dividend payers experience far fewer sharp swings than non-payers, reinforcing their stability.

Source: Seeking Alpha

This reduced volatility equates to a steadier, more reliable path through fluctuating markets. And “fluctuating markets” is definitely how I would describe the past few years… and the outlook for the years ahead.

Part 2: The $6.3 Trillion Opportunity

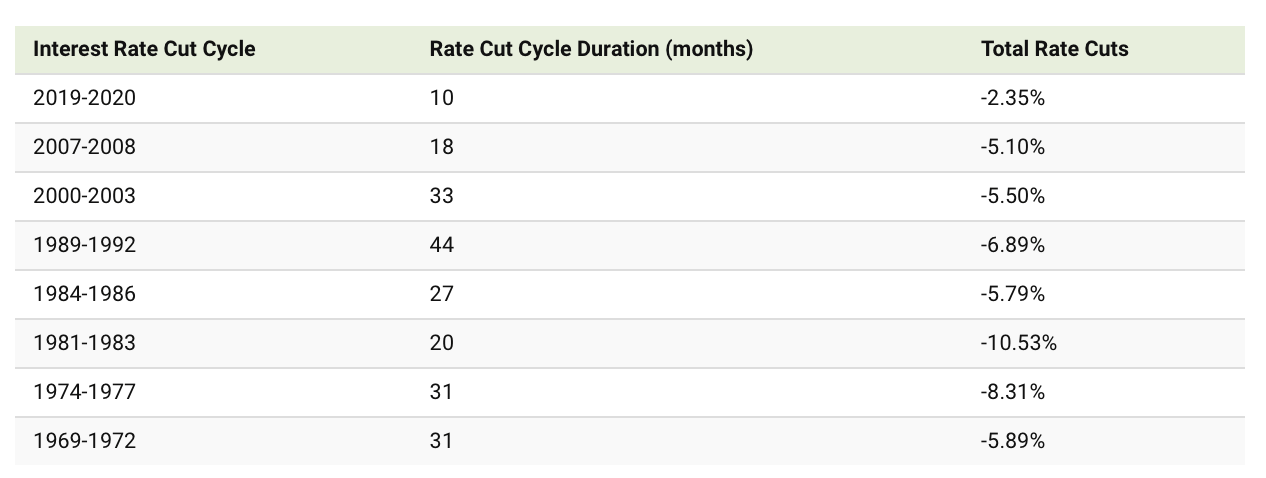

Federal Reserve rate cuts have historically been swift and steep, and they often coincide with recessions.

In past rate-cutting cycles, the cuts ranged from 5.10% over 18 months in 2007–2008, to 5.50% over 33 months in the early 2000s.[8]

The easing cycles of the mid-1970s and early 1980s were especially fast (and deep), underscoring the aggressive nature of monetary policy during economic downturns.

Source: Visual Capitalist

This time around, Federal Reserve Chair Jerome Powell remains optimistic that the economy could cool off without significant job losses, potentially avoiding a recession.

On September 18, 2024, the Fed cut interest rates by 0.50%, signaling the start of a new easing cycle. Your outlook on interest rates depends on your lens. Borrowers rejoice at paying less interest. Savers are far less enthusiastic. As rates decline, so does the income they earn from interest-bearing products.

The Fed’s Next Moves

As rates fall, yields on CDs and money market funds—once as high as 5.25% to 5.5%—will also fall, forcing investors to seek alternatives. The obvious choice will be high-quality, low-volatility dividend payers.

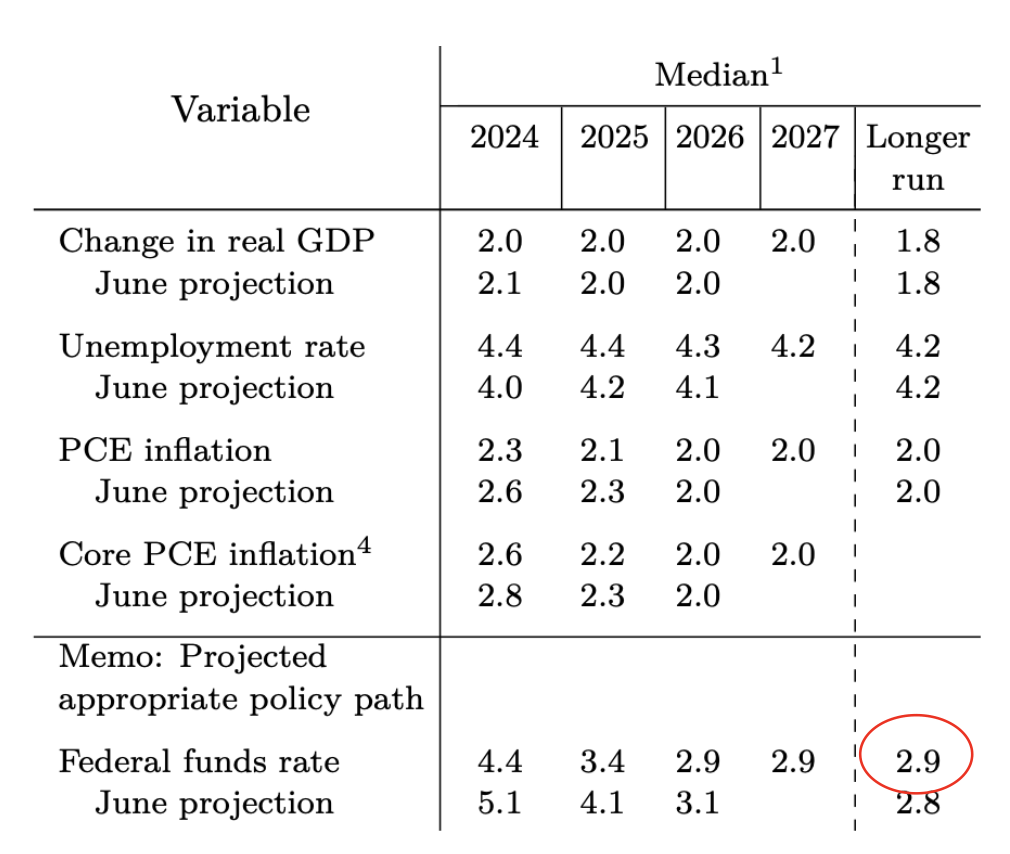

The Fed's Summary of Economic Projections (shown in the chart below) forecasts steady GDP growth of 2% over the next several years. It also predicts further rate cuts, potentially lowering the Federal Funds Rate to 3.4% by the end of 2025, and to 2.9% by 2027.[9]

Source: Federal Reserve

Powell has emphasized the need for balance—cutting rates too quickly could stall inflation progress while moving too slowly could weaken employment.

Nevertheless, after a period of historically high interest rates, where trillions flowed into money market funds, the landscape is set to change. As rates drop, that money will rotate out of those products and into more competitive yielding investments—dividend stocks.

Dividend stocks are going to attract a lot of sidelined cash.

Investors Flock to Safe Havens

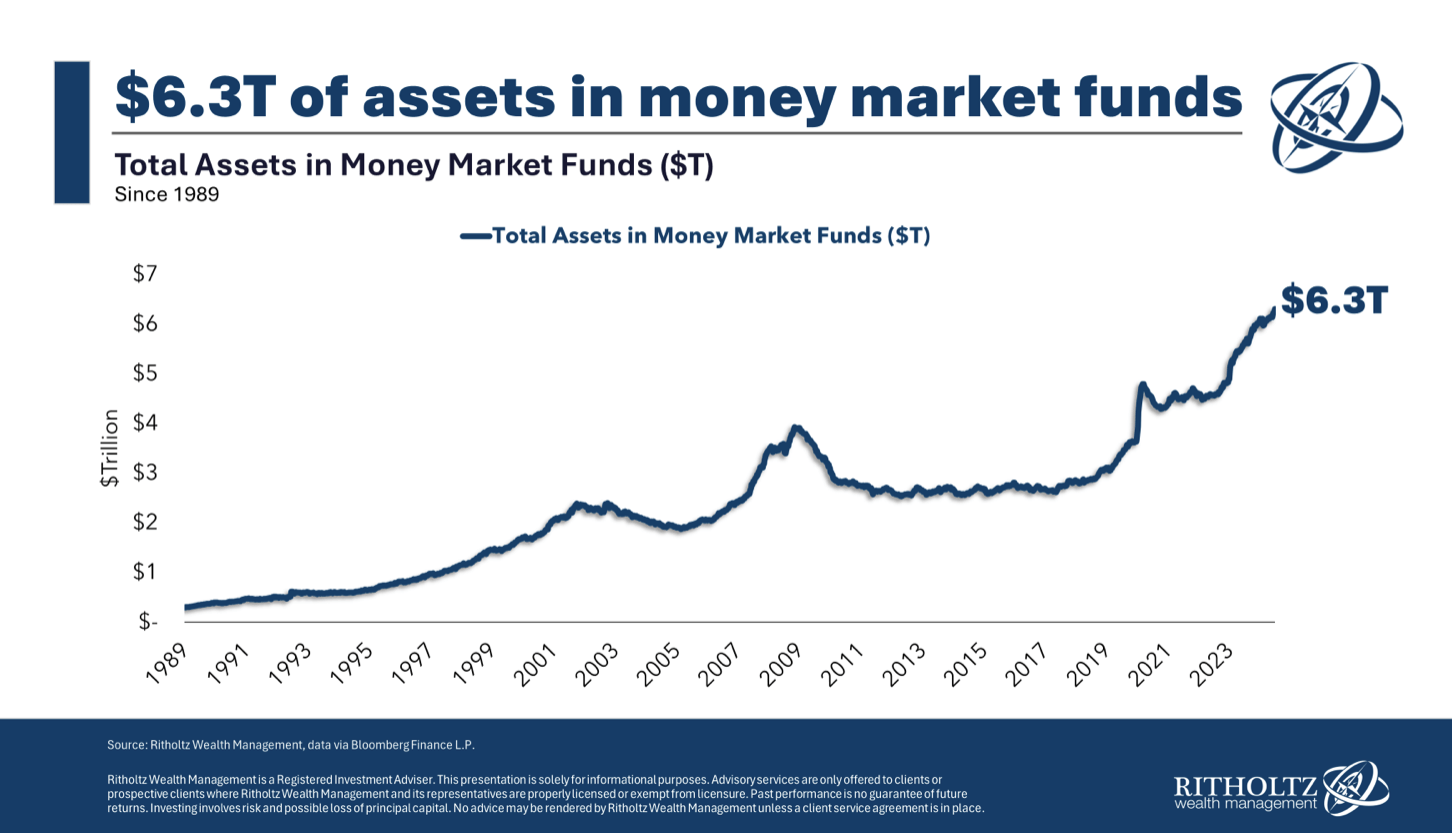

There is currently $6.3 trillion parked in money market funds—nearly double pre-pandemic levels. That’s a massive pile of sidelined cash waiting to make its next move.

As the Fed ratcheted short-term rates to above 5%, it was no surprise to see investors seek the safety of these funds.

With rates now dropping, this is the income opportunity investors will be looking for.

What happens when the Fed keeps cutting rates?

Yields on money market funds, T-bills, and CDs could drop to 2%–3%, making them far less appealing to safety-conscious investors.

At that point, the trade-off between safety and low returns won’t be worth it, and much of that $6.3 trillion will start looking for better opportunities.

While stocks inherently carry more risk, dividend payers offer an excellent balance between income and safety, making them a natural choice in a low-yield environment.

As Jeff Sommer from The New York Times pointed out, even risk-averse investors may be tempted to move out of money markets and into higher-return options like dividend stocks as yields drop.[11]

Not all of the $6.3 trillion will flow into dividend stocks right away. We will see the money flow steadily over time as rates slide lower.

No Matter If Rates Go Up or Down

In what seems unlikely today, we could be living in an entirely different macro-climate in six months, one where rates are climbing.

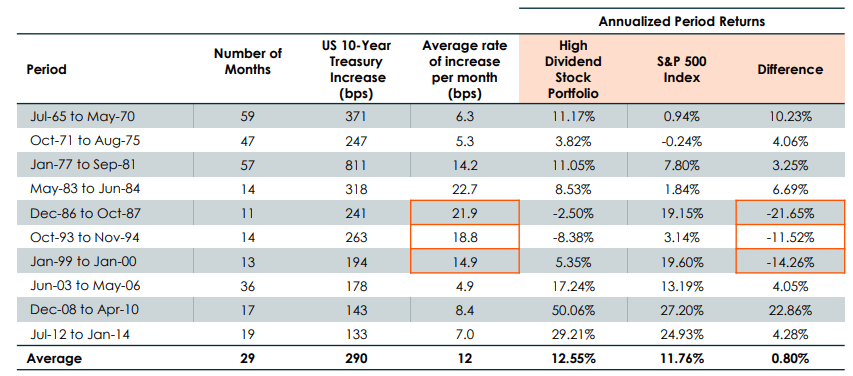

So, how do dividends perform when rates are rising?

History shows that high-dividend stocks have outperformed the S&P 500 in 7 of 10 rising-rate periods since 1960, as shown in the chart below.[12]

Source: GlobalXETFs

During rising-rate periods, high dividend payers beat the S&P by 0.8% annualized. In other rate environments, they outperformed by an average of 3.2% per year.

No matter how the macro environment evolves, dividend stocks can add a powerful combination of reliable income and long-term growth to your wealth-building strategy.

We are in the early innings of a falling-rate environment. Now is the time to act… or risk missing out on a profitable investing opportunity.

Part 3: Now Is the Time to Buy Dividend Payers

Now, I’m not one to predict doom and gloom. The dollar isn’t going to zero. Gold isn’t going to $30,000/oz.

But, anything can happen. Being prepared is the right move. And dividend stocks—especially those with consistent payouts—offer a defensive strategy that shields against volatility and helps build lasting wealth as markets shift.

I never take a firm stance when asked, “Are you bullish or bearish?”

Here’s the truth. I’m always bullish on high-quality dividend payers. At the end of the day, what matters most isn't whether my dividend stocks go up or down.

What matters is my yield and how hard my dividends are working for me.

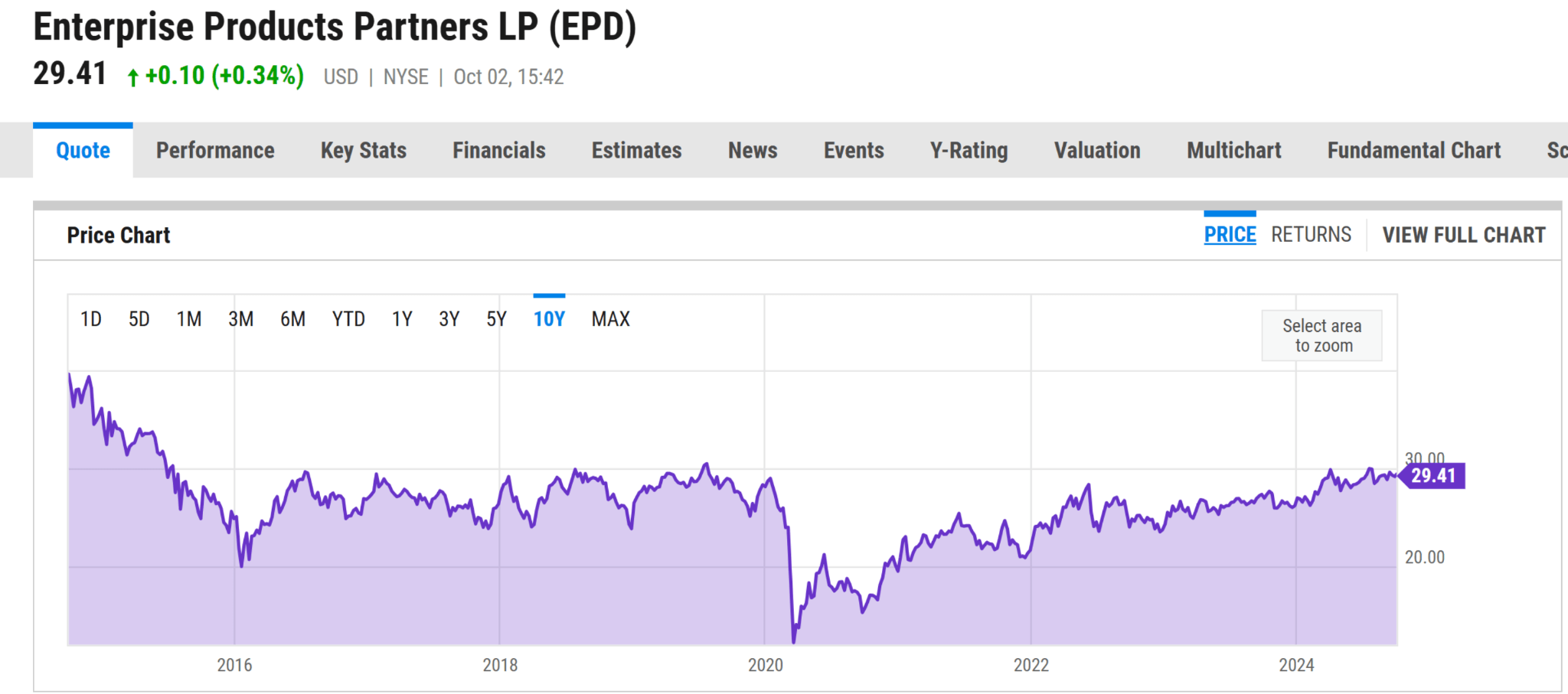

Take my favorite stock over the past 10 years: Enterprise Products Partners (EPD).

For most of that time, it’s traded between $20 and $30 (excluding the COVID crash) and has consistently paid a 7%–10% yield.

Source: Y Charts

When shares dip, I buy more for a better price. And I keep collecting my yield, quarter after quarter after quarter. I use price fluctuations to my advantage.

The Ongoing Search for Yield

If dividends are a proven strategy that has delivered steady income through every market cycle, no matter how turbulent, why is now the time to act? The yields on money markets and CDs haven’t changed much yet. And if dividend stocks see less volatility, why should we feel rushed?

It’s basic math.

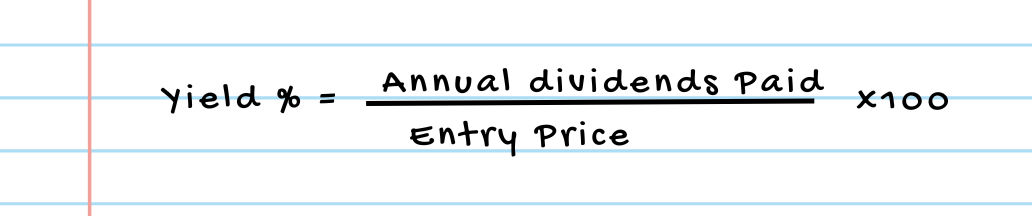

A stock’s yield is what we calculate to compare it to the interest rate on banking products, like money market accounts and CDs. Here’s the math:

Price and yield are inversely related. That’s where the magic happens. When a dividend stock’s price goes down, its yield goes up. That’s why you want to buy dividend payers at the best price… you will get the highest yield.

If the Fed continues to cut rates—which seems all but certain at this point—money will flow from interest-bearing products and into dividends stocks.

When that happens, the share price of solid dividend payers will get bid higher and higher… and yields will get pushed lower and lower.

The best time to build and deploy a dividend strategy is before those trillions of dollars start to move. That’s right now!

Let Dividends Work for You

Dividends are easy to love for two reasons:

They will help you achieve your goal of higher income streams today and help you build wealth for the future.

The strategy requires little day-to-day monitoring.

You won’t be day trading or timing the market.

You won’t be stuck at a computer watching every market gyration.

You won’t be second-guessing every headline.

You won’t lose sleep about what tomorrow has in store.

Instead, you will receive a steady income stream while protecting your principal—building real wealth while enjoying your life.

That’s why I’m always bullish on dividends.

Dividends are always working for you. And your yield is how you measure the horsepower of your money.

A Simple Hands-Off Way to Build Wealth

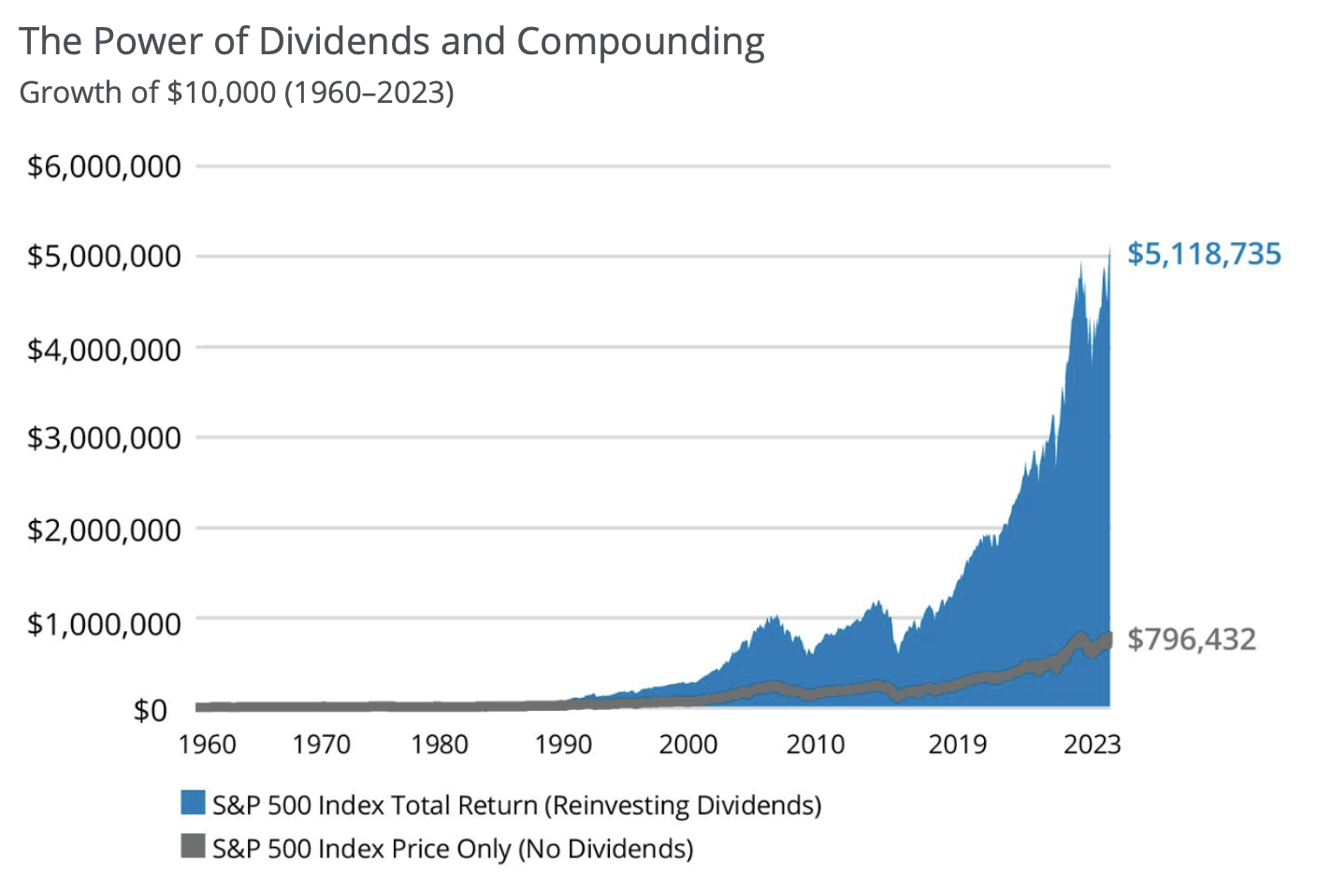

Since 1960, 85% of the S&P 500's cumulative total return was due to one thing—reinvested dividends.

Dividend reinvestment is simple. Instead of collecting your dividends as cash, you use them to buy more shares of stock.

The next time you receive a dividend, you’ll collect it on your originally purchased shares plus the new shares bought with the previous dividend. You’ll be collecting dividends on your dividends. It is the height of wealth building.

A $10,000 investment in the S&P 500 in 1960 would have grown to $5.1 million in 2023 with reinvested dividends. That figure plummets to just $796,000 if dividends had been taken as cash.[13]

Source: Hartford Funds

And the compounding effect of dividend reinvestment offers far greater potential than fixed-income interest compounding.

Investors accumulate more shares as dividends are reinvested. In turn, those added shares generate even more dividends, creating a compounding loop.

Here are two scenarios that illustrate the difference:

|

Dividend Reinvesting vs. Compound Interest |

||

|

After 30 years: |

After 50 years: |

|

|

Investor A earns a fixed 4% annually from interest |

3X return |

7X |

|

Investor B reinvests dividends |

7.5X return |

30X return |

Both investors start with the same dollar amount. Interest is compounded for Investor A. A modest 3% annual dividend increase and stock price gain are assumed for Investor B.

The “stacked” compounding of dividend reinvestment and share growth creates exponential returns, making it one of the most powerful wealth-building strategies.

The best part about reinvesting dividends? It’s simple.

Most brokerage accounts allow investors to automatically reinvest dividends at no extra cost. You simply click the “Dividend Reinvestment” box next to those shares. This makes it easy to grow your portfolio over time without any additional effort.

The longer you hold these shares, the more that compounding will supercharge the potential growth of your money. This means that the money you have earmarked for wealth building and reinvestment should be in stocks that you could hold for years or even decades to come.

Don’t Forget About Dividend Royalty

“Dividend Royalty” isn’t an actual market term. It’s the label I use to describe two groups of dividend payers—Dividend Aristocrats and Dividend Kings.

Dividend Aristocrats are S&P 500 companies that have raised their dividends every year for at least 25 consecutive years.[14] They must have a market cap of at least $3 billion and an average daily trading volume of at least $5 million for three months before acceptance.

Dividend Kings is a lesser-known group. For membership, a company must have raised its dividend every year for 50 consecutive years. This is the only requirement.

Dividend Aristocrats are renowned for their financial discipline and resilience, especially during economic uncertainty or rising interest rates. These companies combine steady dividend growth, strong balance sheets, market outperformance, and defensive strength in downturns.

Those traits make Dividend Aristocrat stocks ideal for long-term holding—years or potentially even decades—and perfect candidates for dividend reinvestment.

There are only 67 stocks in this elite group. And their average yield is 2.3%, higher than the 1.9% yield of the benchmark S&P 500.

This is a great place to start, but not all great long-term holdings meet these stringent requirements. So, while they are a solid foundation for the wealth-building section of your portfolio, they do not encompass all lucrative dividend payers.

Part 4: What to Do Next

Amplify Your Income in a Shifting Market

We've explored how economic shifts and rate-cutting cycles ahead present a rare window of opportunity for dividend investors.

The decline in interest rates will drive trillions of dollars away from money market funds, and investors seeking safe, competitive yields will naturally turn to high-quality dividend stocks.

We’ve seen how dividend payers consistently outperform, delivering strong returns in both bull and bear markets and in all interest rate environments.

Their ability to provide stable income and protect against volatility makes them the ideal investment vehicle for navigating uncertain economic climates.

Even though dividends are timeless, we are in a window of opportunity to lock in the best entry prices on new positions right now. Since price and yield are inversely related, this means a higher yield to meet our investing goals.

If you’re looking to build wealth, look toward dividend growers including Dividend Aristocrats. And use dividend reinvestment to amplify the growth of your wealth.

I call these Bedrock Income stocks. Some of my favorites include an American pharmaceutical company out of Illinois, a global agricultural producer, and a midstream natural gas and crude oil pipeline company based out of southern Texas.

If you’re looking to generate large streams of passive income without giving up safety, look toward stocks with special designations or beaten-down share prices with the potential to recover.

I call these Current Yield stocks. In our portfolio, we have a business development company that is currently delivering an effective yield of 11.3%, while a global shipping and mailing company pays over 10%.

Dividends remain as essential today as they were in the 1600s—ensuring clarity and confidence in times of economic uncertainty.

As conditions shift, dividend-paying stocks are poised to capture the capital flowing out of low-yield assets, delivering both defensive stability and offensive growth potential.

With interest rates declining and dividend stock prices still low, this window of opportunity won't last long.

In my premium research service, Yield Shark, I guide investors through these exact opportunities, every step of the way.

I identify the best high-dividend-paying stocks to suit any investing goal. My focus is on navigating market shifts and providing strategies to build wealth while managing risk.

Whether your focus is on generating reliable income, growing your portfolio, or positioning yourself for market rotations like this, Yield Shark has you covered.

To learn more about how Yield Shark can help you capitalize on dividend opportunities and help you build lasting wealth, click here.

[1]https://www.beursgeschiedenis.nl/en/moment/voc-the-start-of-global-share-trading/

[3]https://blog.countercyclical.io/posts/a-history-and-evolution-of-value-investing

[4]https://www.osam.com/Commentary/dividend-history

[5]https://seekingalpha.com/article/4311879-dividend-stocks-outperform

[6]https://seekingalpha.com/article/4311879-dividend-stocks-outperform

[7]https://www.hartfordfunds.com/dam/en/docs/pub/whitepapers/WP106.pdf

[8]https://www.visualcapitalist.com/visualized-past-interest-rate-cut-cycles-and-2024-forecasts/

[9]https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240918.pdf

[10]https://awealthofcommonsense.com/2024/09/what-happens-to-the-money-market-cash-on-the-sidelines/

[11]https://www.nytimes.com/2024/09/06/business/interest-rates-falling-downside.html

[13]https://www.hartfordfunds.com/insights/market-perspectives/equity/the-power-of-dividends.html

[14]https://www.investopedia.com/terms/d/dividend-aristocrat.asp